The Rise of Online Resale Platforms

For many years, shoppers have rummaged by way of rails at flea markets or charity retailers, searching for classic gems or only a discount. However the sale of second-hand clothes has been catapulted right into a

For many years, shoppers have rummaged by way of rails at flea markets or charity retailers, searching for classic gems or only a discount.

However the sale of second-hand clothes has been catapulted right into a digital age of fast development, dealmaking and sky-high valuations.

However 2021 has additionally seen ThredUp and Poshmark record within the US and Gucci owner Kering take a 5 per cent stake in Vestiaire Collective, the upmarket France-based resale platform. Vinted, a European resale web site, tripled its valuation in a funding spherical final month.

A very powerful driver of the resale development is know-how, which has reworked what was usually a serendipitous treasure hunt into an Amazon-style “limitless aisle”.

“You want to have the ability to discover what you need in your dimension and in bodily retail that’s at all times going to be a problem,” stated Maximilian Bittner, chief govt of Vestiaire Collective, which facilitates commerce in mid to high-end pre-owned clothes in about 70 nations.

One other development driver is the Covid-19 pandemic: wardrobe clear-outs throughout the globe fuelled gross sales whereas prolonged durations of store closures in lots of nations spurred demand. Income at Depop doubled final 12 months, although it’s nonetheless pretty modest at $70m and buyers had been upset with current development at ThredUp and Poshmark.

She factors out that regardless of their superficial similarities, they’ve completely different enterprise fashions. Depop is a pure peer-to-peer platform, the place sellers and consumers kind every thing out between themselves. Vinted works an identical means, however consumers pay fee and a price for cover in case of non-delivery or faults.

Distributors additionally do a lot of the work on Vestiaire however the platform requires authentication on all objects marketed for €1,000 or extra — a service for which the client pays a hard and fast price — in an effort to fight fakes.

New York-listed RealReal, which focuses on luxurious, is much more hands-on; it writes descriptions and images objects on behalf of sellers.

As many of the platforms are funded by enterprise capital, particulars on monetary efficiency are largely personal. However James Clever at Balderton Capital, which is an investor in each Depop and Vestiaire, says they’re characterised by excessive gross margins and highly effective operational leverage.

“They don’t have logistics arms, they don’t do supply. It’s not a enterprise the place the margin scales incrementally per greenback [of revenue], it scales exponentially,” he stated.

He expects very massive companies to emerge in particular person sectors, pointing to StockX’s dominance of sneaker resale for example, though Vinted’s chief govt Thomas Plantenga stated he meant to supply breadth quite than depth: “We aren’t targeted on a sure sector, we promote all sorts of clothes.”

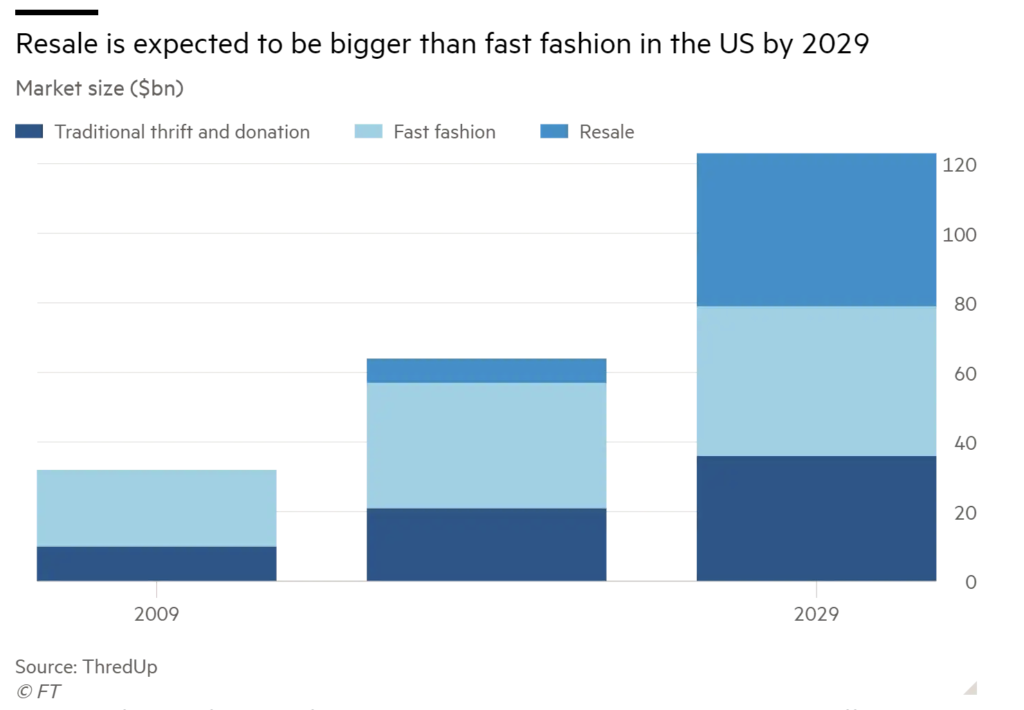

How large the resale sector is, or might finally be, is difficult to gauge because of the fragmentation and casual nature of most of the transactions.

A current report for ThredUp by GlobalData forecast that resale within the US would develop 39 per cent a 12 months between 2019 and 2024, to succeed in $36bn.

German on-line vogue retailer Zalando just lately predicted 15-20 per cent annual development globally over the approaching 5 years. Its survey discovered that whereas three-fifths of shoppers believed shopping for second-hand was an effective way to buy sustainably, solely 1 / 4 achieve this.

Conventional operators don’t consider that digital upstarts are taking important share from them. Depop and its ilk “have highlighted how good second-hand will be and the halo impact of that has been good for us”, stated Kate Avenelli, head of retail at Save the Youngsters, which runs 120 charity retailers throughout the UK and already works with eBay, Asos and Depop.

Jenny Macdonald, who has run The Magic Wardrobe pre-owned clothes boutique in Essex, within the east of England, for 14 years, is assured her enterprise will proceed to lure clients. “Folks can are available right here with £50 and get a complete outfit, it simply makes me so happy,” she stated.

Plantenga stated he had little doubt that “the place we enter a market we’re completely rising that market”.

“Second-hand is a really immature market, it’s only simply beginning to develop . . . there can be area for a number of market gamers in future,” he added.

Windsor at PwC believes second-hand will more and more encroach on quick vogue turf. “Teenagers don’t assume by way of resale versus new. They give thought to what they will get for the quantity they have.”

This mindset poses an enormous problem for established vogue manufacturers, which should both collaborate with platforms, launch their very own resale companies or perish, says Clever. “That is an existential query for a few of these manufacturers . . . they will be beneath stress for a decade to come back.”

He provides that whereas manufacturers corresponding to Levi Strauss and Hennes & Mauritz have entered resale, for a lot of attempting to compete “can be like Barnes & Noble launching its personal Kindle and attempting to de-platform Amazon”.

Bittner says that whereas “each vogue CEO has thought of this”, they don’t have entry to the identical pool of consumers and sellers as platforms and are more and more conscious that second-hand is a technique to introduce new clients.

Vestiaire operates a concession in London’s Selfridges and just lately teamed up with Alexander McQueen to permit distributors to promote pre-owned objects by way of its web site in return for credit score for use at McQueen boutiques. Depop has resale collaborations with Adidas, Benetton and Ralph Lauren.

“We’re educating the buyer to purchase objects which are extra sturdy and types can enhance buyer loyalty by encouraging clients to commerce in,” stated Bittner.

Via Financial Times

English

English