Post C-19 Will See Demand Shift From Product to Service

Brick-and-mortar retail was already facing challenges on many fronts. Traditionally, consumers have been shifting their spending from the material to the experiential, and after many weeks of ecommerce buying, post-crisis online retail will surely be

Brick-and-mortar retail was already facing challenges on many fronts. Traditionally, consumers have been shifting their spending from the material to the experiential, and after many weeks of ecommerce buying, post-crisis online retail will surely be the default shopper preference for most product and service purchases. Physical retail stores need to evolve to survive.

Service has already been winning: consumers are prioritizing experiences over products, with 76% preferring to spend on experiences over products—driving a paradigm shift in stores to the effect of service retailers overtaking product retailers for the first time, and restaurant counts increasing 30.9% between 2002 and 2017. In the ‘next normal,’ leading retailers will be rethinking their offerings, catering services to generate a new revenue stream, cultivate brand community, boost traffic and dwell time, and strengthen consumer loyalty.

So what services are leading the pack? Those that enable convenience, naturally, but also those that foster community. Our research further revealed a need to provide entertainment and even wellness experiences—delve into the list below for the service trends driving the evolution of the brick-and-mortar store.

Click, Collect and Beyond — Retailers are providing optimal support through pick-up and return capabilities, curated product selection and value-added services around consumers’ lifestyles. Take a look at our case study on Box by Posti, a click-and-collect service that is leveling up the experience by providing customers with changing rooms and hosting events in addition to its counter for unboxing and recycling.

On-Demand Discovery — Partnering with brands to help customers discover and test products through on-demand treatments and consultations. Check out this beauty consultation cafe based in Japan that directors tourists to the country’s best services for their needs, from clinics to where to find the best J-beauty products.

Peer Platforms — In order to feel a meaningful bond with a given brand, 58% of consumers say it’s important that the brand allow them to connect with other like-minded customers through online platforms and programmed events. Accordingly, retailers are focusing on creating spaces (virtual or IRL) for consumers to receive advice and support from peers and participate in shared experiences.

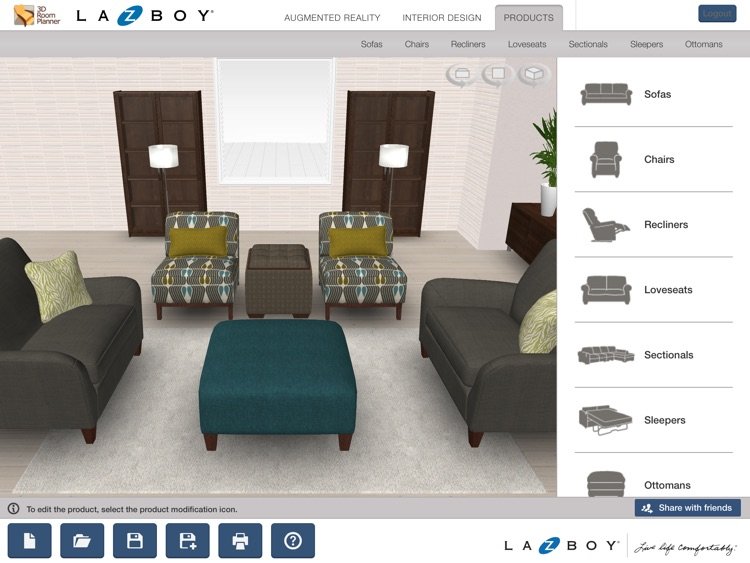

Expert Education — Connecting consumers directly to expert sources through in-store or online studios and workshops, where one-on-one and custom experiences generate brand affinity and consumer trust. Furniture maker La-Z-Boy’s designers and associates, for example, offer enhanced service to customers through the VR Room Planner tool, a 3D previewing experience available to both store visitors and online.

VIP Value — Rewarding brand evangelists with exclusive access to services, drawing on the power of exclusivity to inspire other brand-fans to achieve similar status. This can look like menswear label Hackett London’s reserved store area for its membership program, Club 65B, which offers participants added-value options like monogramming and customized embroidery as well as grooming services.

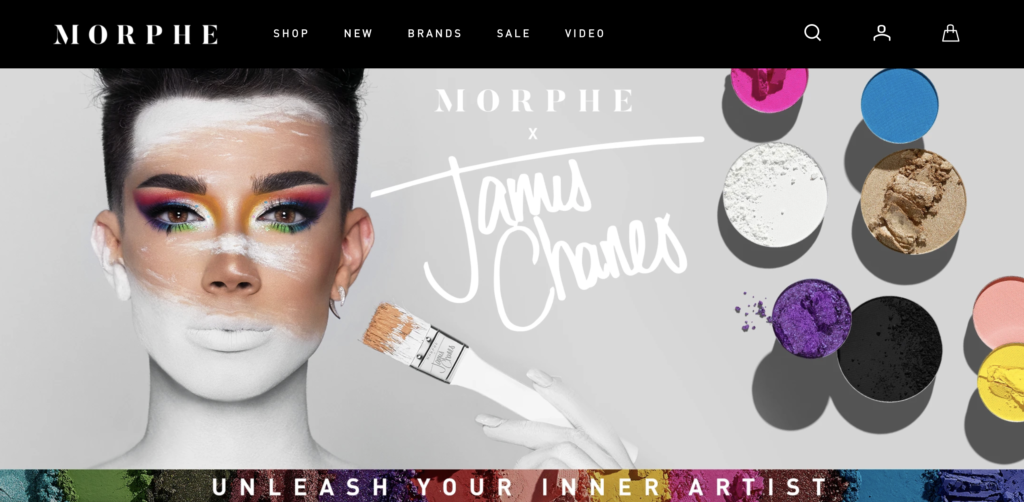

Store As Studio — Positioning the store as a creative studio, empowering and engaging brand fans by involving them in content creation. Beauty brand Morphe is doing so by inviting all consumers to become creators at its professional video production studios that double as makeup application spaces.

Health Hub — Integrating fitness activities and healthcare programs as an extension of the store, giving consumers easy access to health-based services while organically introducing them to related wellness product assortments. U.S.-based supermarket chain Hy-Vee’s Midwest store, for instance, debuted a HealthMarket concept complete with a pharmacy, clinic, and even nutrition support for shoppers.

Urban Oasis — Offering a respite for urbanites, retailers are designing physical locations focused around wellness rituals and services. Seoul’s Amore Seongsu sells nothing but invites customers to relax while perusing and testing its vast range of beauty products from parent brand Amore Pacific.

While many of these trends were emerging before the crisis hit, researchers think these particular ones could dominate as communities around the globe open for business, and expect to see retailers focus more on creating deeper value for customers through specialty services and resources. So how to prepare for this shift?

One final case can provide inspiration: After having to close all of its retail stores, women’s athleisure brand Vuori decided to make the most of the downtime for employees, launching a three-month program designed to turn associates into experts across key business areas like product or brand—in the hopes of emerging from the crisis ready to provide strong service in the next normal.

Via PSFK

English

English