7 Experiential Store Concepts That Dominated 2021 Retail

From Dick's Public Lands outdoors banner to Bloomie's to Ulta's Target shop-in-shops, here are some of the most notable concept launches this year. As in past years, testing store concepts has been top of mind for retailers in

From Dick’s Public Lands outdoors banner to Bloomie’s to Ulta’s Target shop-in-shops, here are some of the most notable concept launches this year.

As in past years, testing store concepts has been top of mind for retailers in 2021, as the industry moved past the mass closures and severely dampened traffic of 2020.

For some DTC brands, that means returning to physical retail after abandoning it last year or testing their first brick-and-mortar presence now that the environment is more favourable. For more established players, it means expanding recent store concept initiatives, introducing new formats and solidifying partnerships for shop-in-shops to make the in-store experience more compelling.

Nike, for example, has continued to expand its Nike Live concept this year and unveiled the “pinnacle expression” of its relatively new Nike Rise format in August. Dollar General has also been in expansion mode this year. The dollar store’s Popshelf format has been ramping up since its launch in 2020, with the company planning a big future around the slightly more upscale concept.

And retailers are by no means done. Already, Macy’s has announced plans for 400 shop-in-shops with Toys R Us in 2022 and Victoria’s Secret intends to test a new store concept in 10 locations that year as well.

For many, but not all, the piloting of new formats has been done in pursuit of experiential retail, the lofty concept that stores can do more than just sell products. That they can offer shoppers community and entertainment through the likes of services, classes and local events. For others, new formats are just a way of reaching a different market.

Regardless of the reason, here are some of the most interesting store concepts and shop-in-shop partnerships that launched this year.

1. Dick’s House of Sport and Public Lands

Dick’s has earned the right to be mentioned first in this article, if only because the sporting goods retailer has tested so many different concepts in 2021. Starting during the pandemic, the retailer began opening various off-price formats, the latest of which (dubbed Going, Going, Gone) debuted in May this year. Dick’s has been actively revamping locations, including reimagining the experience at its Golf Galaxy stores and opening enhanced soccer shops at some of its core fleet.

But the big news from Dick’s are its House of Sport concept and its new Public Lands banner (the latter of which is branded as Public Lands, not Dick’s). In April this year, the retailer’s experience-driven House of Sport format debuted, featuring everything from a rock climbing wall and a turf field to a putting green and racket stringing. Analysts expect the retailer is using the concept to test every experience it could potentially offer and eventually roll out the winning ones, so to speak, to the rest of its fleet. Already, some of the golf services offered at House of Sport are being introduced to its golf stores.

Public Lands is a completely different venture. Announced in November and launched in September this year, the banner is an outdoors-focused business that competes more directly with the likes of REI. It’s got an environmental mission and, to some extent, serves as a replacement for the Field & Stream stores Dick’s is exiting, though without the emphasis on hunting. Analysts think it could be a powerful growth vehicle for the company as outdoors has gotten a boost over the past year or so.

2. Target’s Ulta shop-in-shops

In a deal that brings together two retail powerhouses, Target and Ulta in November last year announced their plans to open Ulta shop-in-shops within Target stores. The first Ulta shop-in-shops opened in August, with 58 up and running by the end of Ulta’s Q2, and 100 total slated to be open by the end of the third quarter.

The 1,000-square-foot concepts are designed to feel like an “extension” of Ulta’s own physical stores, including with special training for the associates that man them; the idea is that current Ulta shoppers get what they’re looking for and new ones are also drawn in. While the initial rollout includes just 100 locations, Ulta and Target are planning for 800 over time, and Ulta executives have already said they’re “thrilled” with how the shop-in-shops are going.

“Each aspect of the shop was thoughtfully designed to make the space feel authentic to Ulta Beauty, Target and the featured brands within the assortment,” Ulta CEO Dave Kimbell said on the retailer’s Q2 earnings call. “From the unmistakable Ulta Beauty orange pop canopies and vivid graphics that weave into the existing Target store, everything was designed to create an inspiring and unique beauty experience for guests.”

For Target, the Ulta deal is just one in a number of shop-in-shop formats the retailer is rolling out. In February, the mass merchant announced it would be opening 17 Apple shop-in-shops, with planned expansion this fall, and in August said it would triple the number of Disney shop-in-shops in its stores ahead of the holidays.

3. Bloomingdale’s small-format Bloomie’s concept

With department stores still under pressure, Bloomingdale’s is hoping to reinvent itself with a 22,000-square-foot format dubbed “Bloomie’s.” The smaller format is located in Fairfax, Virginia’s Mosaic District, notably outside of the mall, and builds off of a similar strategy pursued by parent company Macy’s.

Not only has Macy’s announced its own plans to move outside of the confines of the mall, but the legacy department store has also tested its own small format concept, Market by Macy’s. Bloomie’s, which opened in August, features men’s and women’s apparel, accessories, shoes and beauty, as well as centralised services like a returns dropbox and curbside pickup. The concept is meant to offer “everything [customers] love about Bloomingdale’s in a highly edited, convenient, and unexpected way,” Bloomingdale’s CEO Tony Spring said in a statement.

The store frequently rotates trends, hosts activations and features carts throughout the store that prompt product discovery.

4. The Sephora at Kohl’s beauty shops

Adding to the list of high-profile beauty partnerships, Sephora and Kohl’s in December last year revealed plans for “at least” 850 Sephora shop-in-shops within Kohl’s. While that 850 number won’t be reached until 2023, 200 of the locations are expected to open by this month. The initial 70 began rolling out in August, which is also when Sephora and Kohl’s launched the online experience for the partnership.

Ulta and Target stole some of the thunder out of Sephora’s deal with Kohl’s, as their announcement came just a month earlier. However, the two partnerships vary in some key ways. For one thing, Sephora teaming up with the department store comes at the expense of J.C. Penney, who it currently has a deal with. Those Sephora shop-in-shops will wind down by early 2023, the beauty retailer said.

Sephora’s deal with Kohl’s also has a far bigger footprint than Ulta’s Target shop-in-shops, at 2,500 square feet. The experience features Sephora-trained beauty advisors, testing and discovery zones, a rotating assortment, and in-store returns and pickup.

5. Casper’s shop-in-shop at Bed Bath & Beyond

Casper has teamed up with a lot of retailers over the years as it expands its roster of wholesale partners. In July this year, the DTC mattress brand announced its 28th wholesale deal with Mattress Warehouse, one of the traditional players it had entered the space to disrupt. A limited list of other partners includes Sam’s Club, Target and Nordstrom.

However, Casper also launched something new for the company in 2021. On July 22, the DTC brand opened its first branded shop-in-shop at Bed Bath & Beyond’s flagship in New York City. Bed Bath & Beyond will offer the DTC brand’s products at other locations as well, but the New York City store is unique in offering a Casper shop-in-shop.

“Casper will create one-of-a-kind, immersive in-store shopping experiences of its award-winning suite of sleep offerings to Bed Bath & Beyond customers,” Casper said in a release about the shop-in-shop.

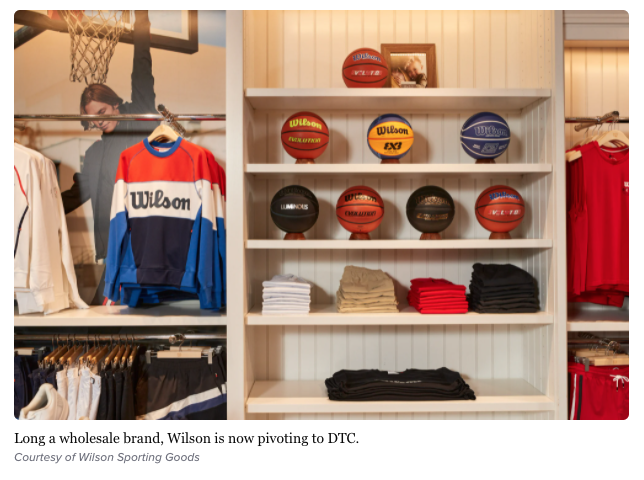

6. Wilson’s first-ever brick-and-mortar stores

In 2020, Wilson was a brand most known for supplying sports equipment to the likes of Dick’s Sporting Goods. In 2021, the company pivoted its strategy to become a retailer in its own right, launching its first-ever physical storefront. Part of a DTC expansion, the sporting goods company is not only shifting its focus to brick and mortar but also extending its influence into the apparel space.

Wilson’s first store, at 2,247 square feet, opened in Chicago in July and sells both the company’s new apparel line and an assortment of sports equipment. Like many in the athletics space, the well-known brand is aiming to bring uniqueness and experiences to its customers through exclusive seasonal drops, limited edition products and special events. Wilson described the Chicago store as a “test lab” for gathering feedback — and in May outlined plans for stores in New York, Shanghai and Beijing as well. The company later added plans for a store in Los Angeles.

“Following the launch of our Wilson Sportswear line earlier this summer, it was important that we introduce physical retail locations so that our athletes can experience and interact with our sports equipment and apparel in person,” Gordon Devin, president of Wilson Sportswear, said in a statement about the brand’s Chicago store opening. “Our first-ever retail location centres around Wilson’s heritage, serving as a physical ‘love letter’ to our city.”

Prior to the launch of its permanent Chicago location, Wilson in August debuted a tennis-focused pop-up in SoHo ahead of the U.S. Open featuring racket customisation, and an entire floor dedicated to tournament viewing and events.

7. Nordstrom’s Indochino shop-in-shops

Workwear has had a tough time over the past year and a half, to say the least. Broadly, consumers just haven’t had the same need for it as in prior years when commuting into the office was a daily task for much of the working population. That’s meant that retailers selling formal wear and workwear have needed to pivot or grow their offerings to stay afloat.

Some of the dark clouds around the category have receded, though, as more events open up again. In that landscape, Nordstrom and Indochino announced a deal for the DTC custom apparel brand to open 21 shop-in-shops at the upscale department store in June and July. As a retailer that prides itself on service, the Indochino partnership makes sense for Nordstrom, as it is a highly service-oriented model.

Nordstrom shoppers interested in the brand’s apparel work with Indochino salespeople to choose fabrics and customisation options for their clothing, including lapels, buttons, pockets, lining and monogramming. Apparel is then made to measure and sent directly to customers within two to three weeks. Nordstrom also offers complimentary alterations for all Indochino customers.

“We have long admired Indochino as a leader in made to measure suiting and apparel and we are excited to bring the Nordstrom customer a new bespoke experience in our stores,” Shea Jensen, executive vice president and general merchandise manager of women’s and men’s ready to wear at Nordstrom, said in a statement on the launch.

Via Retail Dive

English

English